Wendy Ouedraogo visits Carnegie Library of Pittsburgh’s main branch in Oakland regularly to access its free internet. She is not alone. For many in Pittsburgh, the library is a reliable resource for services they can't afford at home.

Almost everybody can get to the library. In fact, Allegheny County’s public libraries offer more than books. They are where people rent DVDs, receive tutoring on foreign languages or assistance with job applications, and, as is the case with Ouedraogo, use the internet. All for free.

Those services and other public resources in Allegheny County are in large part funded from an extra 1-percent sales tax made in Pittsburgh. Which Ouedraogo is happy to pay.

“Absolutely it would be helpful to see the library get more funds,” says Ouedraogo. “Especially for the elderly and for the kids. Not everyone can afford to have everything available at home.”

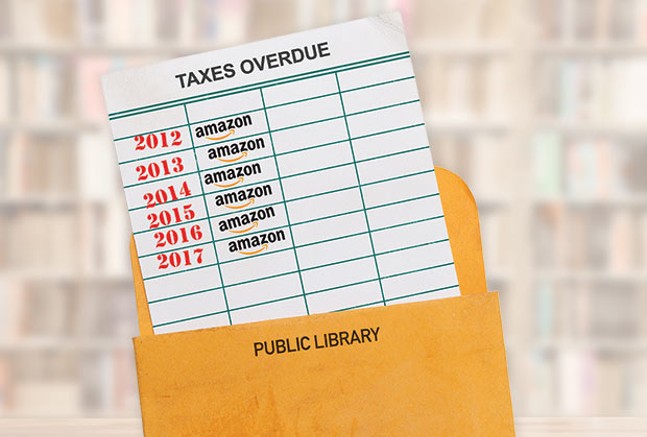

A certain online goliath that city and county officials hope will make Pittsburgh home to its second headquarters can afford everything. But Amazon, the largest online retailer in the U.S., isn’t collecting a local sales tax — and the result is Allegheny County libraries missing out on $1.49 million annually, a City Paper analysis shows.

A study by the Institute on Taxation and Economic Policy concludes Amazon isn’t collecting the 1-percent sales tax Allegheny County levies on local purchases. The Regional Asset District (RAD) tax contributes to public parks, museums and distressed municipalities in addition to generating more than $31 million yearly to public libraries.

Amazon officials did not respond to City Paper’s request for comment.

Not only Pittsburgh and Allegheny County are being left out. Amazon also isn’t collecting a 2-percent sale tax in Philadelphia, and it isn’t contributing extra sales-tax revenues to counties in Alabama, Iowa and New Mexico.

Walmart and Target each collect extra sales tax, even on their online purchases, that contribute to public services in Allegheny County. The revelation that Amazon is avoiding collecting taxes comes at a time when it has chosen Pittsburgh as one of 20 possible placements of its second headquarters, HQ2.

County officials reportedly have offered many tax incentives to Amazon, which has promised 50,000 jobs to the region. Details, though, have not been made public.

The public was on Rick Stafford’s mind in 1994, when the RAD tax (in which he played an integral role) was instituted. Then with the Allegheny Conference and now a professor at Carnegie Mellon University, Stafford believes the RAD tax is a resounding success, saying it has greatly improved quality of life for residents in Allegheny County.

“I think it is fair to say the parks and the cultural assets contribute to the fact that this is a place that’s interesting, that has a cultural vibrancy to it,” says Stafford. “We have one of the richest park systems imaginable. The library system is far superior than what is was before.”

Stafford says Amazon should be collecting the extra local tax.

“If they are collecting the 6 percent [state sales tax], it is totally hypocritical for them not to collect the 7 percent here or 8 percent in Philadelphia,” he says.

The RAD tax fund would be boosted annually by about $9.6 million if Amazon collected the extra 1-percent sales tax. (CP calculated the average Americans spend yearly at Amazon’s website and multiplied that total by how many people in Allegheny County likely make purchases through Amazon.)

In 2016, Allegheny County distributed $189.7 million to cultural assets and municipalities through the RAD tax. The Carnegie Library of Pittsburgh system relies on the tax for the majority of its budget. The more money the RAD tax collects, the more money the library has to improve and expand services.

State officials said Amazon would start collecting a 6-percent sales tax on purchases and the extra taxes in Allegheny County and Philadelphia, the Tribune-Review reported in 2012.

Graham Martin, a tax law expert at website TaxJar, says Amazon is not required to collect the extra tax because it lacks a retail presence in Allegheny County. Crafton is home to an Amazon sorting center since 2014, but Martin says Amazon can claim all purchases are originated in Virginia — home to the company’s East Coast Web Services campus.

Pennsylvania’s use of an “origin-based” tax law does not compel Amazon to collect the extra tax because Martin says a sorting center, such as the one in Crafton, “is not the place where the order was received.”

“They are not considering that the seller location,” he says.

State officials need to create or amend legislation to specifically include rules about collecting local sales taxes to force Amazon (or similar online retailers) to collect in Allegheny County and Philadelphia, Martin says.

Allegheny County state Rep. Dom Costa and Philadelphia state Rep. Curtis Thomas co-sponsored a bill that forces Amazon to collect 6-percent sales tax on all purchases shipped to the state, including through Amazon’s third-party marketplace. The bill was signed into law this past March, but it does not contain language pertaining to local sales taxes of Allegheny County or Philadelphia.

The Institute of Taxation and Economic Policy’s Carl Davis believes local retailers are at a disadvantage because Amazon is not paying the extra taxes. He sees little logic in asking consumers that shop at local retailers — with owners who pay property taxes and employ thousands of taxpayers — to pay more to fund public services such as libraries than consumers that shop through Amazon.

“It is exactly the opposite thing to do from the place of local economic development,” says Davis.

“We need a level playing field for local business.”

There is also the part about maintaining free services that many people have come to rely on.

Consider Marc Patti, a Duquesne University grad student who had 20 books checked out from the public library when he spoke to CP last week in Oakland. He cannot afford to buy all the books he needs to continue his higher education. What hurts the libraries hurts Patti where he lives, so it is not surprising he favors Amazon collecting the extra sales tax — especially considering Allegheny County is a place Amazon might consider its second home.

“If you want to operate here, you have to play by the rules,” says Patti. “No matter how big of a corporation you are going to build here.”